Customer Credit Group

The Customer credit group allows for a company to create a shared credit limit between customers that can span ACROSS LEGAL ENTITIES. Forgive me for my excitement, but this is huge! This means that if you have a set of customers and you want them to share a credit limit, they will be subject to the terms of the credit limit even if they are doing business with another legal entity within your organization!

In my example, I have a Customer credit group called Contoso Customers. This is the same customer, but they do business in multiple legal entities (USRT, USMF, and USP2). They have a shared credit limit of $1,000,000.

|

| Customers doing business across legal entities can share a credit limit |

Okay, I have some examples for you:

- Big box department store chain with stores and distribution centers across the country. All locations bill to their headquarters. The separate locations, all set up as individual Customer records, can create orders, but you don't want the overall group of them to exceed an established credit limit.

- A grouping of Mom & Pop type stores for which you have an internal policy not to exceed a specific value of total orders invoiced at any given time.

- A franchise that has multiple concepts that all bill up to the parent corporation.

+ Credit limit adjustments on Customer Credit Group

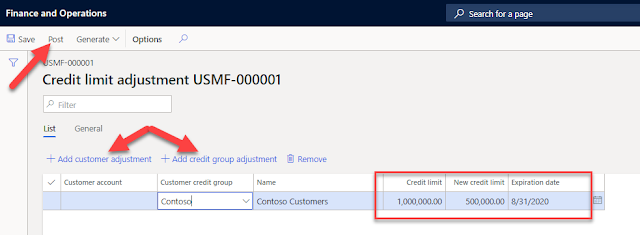

Along the top of the Customer credit group, you may notice a few different options. One of the options is called + Credit limit adjustments. This allows a company to adjust a Customer's credit limit or a Customer credit group's credit limit using a Credit limit adjustment journal.

|

| Adjust a credit limit on a Customer or on a Customer credit group |

You can also add an expiration date to your credit limit. When done adding the new credit limit, click Post.

Temporary Credit Limits on Customer Credit Group

There is an option available on the Customer credit group to review the Temporary credit limits that were applied using Credit limit journals. Temporary credit limit adjustments are used when a business needs a temporary bump in credit or if you feel they are at risk and need to decrease their credit until they are no longer at risk. You can read more about Temporary credit limits on this blog.

This is beneficial because it gives a history of recent temporary credit transactions applied to the Customer credit group.

Aged Balances on Customer Credit Group

You may notice that there is an option for Aged balances on the ribbon in the Customer credit group as well. When selected, this will show your default aging buckets for the customers in the Customer credit group.

|

| Aged balances inside of a Customer credit group |

You may also notice that an individual Customer may have their own credit limit listed. This is set up on the Customer record and it will take precedence over the shared credit limit in the Customer credit group unless it is greater than the shared credit limit.

What this means, is that this Customer is constrained by their specified credit limit, but they cannot exceed the credit limit stated in the Customer credit group. This is beneficial if you want to keep specific customers on a short leash when it comes to their spending but may want to offer a little more wiggle room to one of their counterparts. Imagine this, you can set up a $10,000 credit limit split among three separate concepts in a $2000/$3000/open split. If the customer with no constraint within the Customer credit group spends $9000 out of their $10,000 limit, then the other customers will only have $1000 left to work with before the credit limit is exceeded, regardless of their specific credit limit.

Conclusion

Customer credit groups can be a very powerful tool. They allow you to view a grouping of customers and share credit limits between them. They allow views of aged balances and allow you to adjust their credit limits. They also bridge across multiple legal entities, allowing you to exert greater control over your customer's spending habits.

4 comments:

Hi Kelly,

I have seen your post on the customer credit limit.When created a new credit group and add customers , system considers only the individual credit limit and not the group credit limit for those customers even in scenarios when the credit limit exceeds regardless of their specific credit limits.

Plz help.

thank you

Hi Pratyusha,

There is a parameter that must be set in Credit and collections parameters called Check customer credit groups credit limit. Be sure that this is enabled!

Best, Kelly

Hi Kelly ,

Thank you. I had setup the parameter for group credit limit. However,I notice only the individual credit limits work ,the group credit limit when exceeded or shared amongst customers in that group doesn't warn when credit limit is exceeded for a credit group. Warning messages are given only for the individual credit limits of the customers. Plz help

Hi Pratyusha,

This is where it would be beneficial to use blocking rules and send the Customer to the Credit management hold list if they exceed their credit limit (See blog post about Blocking rules https://www.d365fandom.com/2020/08/credit-management-blocking-rules.html). The old credit limit warnings do not provide the same level of support to credit limits in Customer credit groups.

Cheers!

Kelly

Post a Comment