Something happened while I wasn't looking and now we have a clearer sequencing of Credit management Blocking rules. This has been a much-needed change, and I am happy to report on it!

Credit Management Blocking Rules Sequencing

Credit Management Release to Warehouse Credit Hold Loop

Set up Collections Agents and Customer Pools

When setting up the Credit and collections module in your D365 Finance environment, you will want to ensure that your collections team will have access to work with their assigned customers. Logging in and seeing all of the Customers with all of their information can be an overwhelming experience, making it more difficult for your collections team to do their job. D365 Finance allows for the creation of Collections agents with the ability to filter only assigned information.

Credit Management - Automatic Credit Limits

When creating Automatic credit limits, you can create a set of rules that will take specific criteria into account while quickly and easily applying credit limits. Navigate to Credit and collections > Setup > Risk > Automatic credit limits to begin.

Automatic Credit Limits

When defining Automatic credit limits, you will use the Scoring groups that were created for Risk scores.

Credit Management - Credit Limit Adjustment Journals

At long last, we finally have controls on Credit limits! Sure, you could set security on the Credit limit field, but it was never my favorite thing that the Credit limit field on the Customer was so easily editable.

Credit Management - Calculate Risk Scores

Part of the new Credit management feature is the ability to calculate Risk scores for your Customers. There is a little bit of setup initially, but the value that can be derived from calculating a Customer's potential risk is tremendous!

Credit Management - Workflows

Credit Management - Blocking Rules

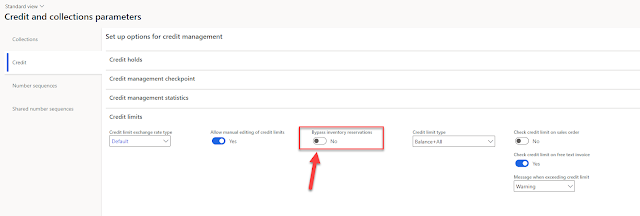

Parameter Setup

Credit Management - New Fields on Customer Record

Here is a great "Before and After" shot of the Credit and Collections FastTab on the Customer record:

|

| Before Credit management feature was enabled |

Credit Management - Customer Credit Groups

Customer Credit Group

Credit Management - Temporary Credit Limits

- The customer is displaying at-risk behavior and you want to decrease their credit limit.

- The customer has filed bankruptcy and you want to limit their spending power in your organization.

- The customer wants to make a one-time purchase that is greater than their credit limit, so you give them a temporary increase to accommodate their purchase.

Credit Management Feature

https://docs.microsoft.com/en-us/dynamics365-release-plan/2020wave1/dynamics365-finance/credit-management

The link above from Microsoft does a decent job of describing the new functionality from a 10,000 ft view, but what it doesn't describe is the more intricate features of this that will have your Credit and Collections team giddy with joy.