One concept in Credit management is the ability to easily apply temporary credit limits to your Customers. This can be done for a variety of reasons such as:

- The customer is displaying at-risk behavior and you want to decrease their credit limit.

- The customer has filed bankruptcy and you want to limit their spending power in your organization.

- The customer wants to make a one-time purchase that is greater than their credit limit, so you give them a temporary increase to accommodate their purchase.

Whatever your reasons, you need to adjust their credit limits for a period of time before reverting back to their regular credit limit. This is done through Credit limit journals.

Temporary Credit Limit Journals

Credit limit journals can be accessed at Credit and collections > Credit limit adjustments > Credit limit adjustments.

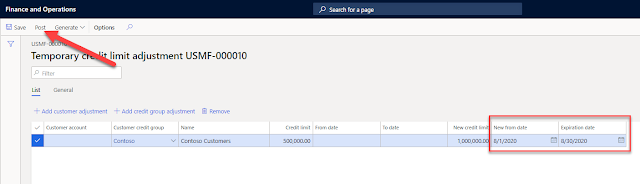

Once in the Credit limit adjustment screen, you will see that Credit limit adjustments are set up as journals that must be posted. In order to apply a Temporary credit limit, you must begin a new journal and select Credit limit adjustment type Temporary credit limit. Then, navigate to the Lines to view your temporary credit limit adjustments.

|

| Credit limit adjustments are handled through journals |

In the lines, you have an option to set a Start and End date for the temporary credit limit. You can apply a temporary credit limit to a Customer or Customer credit group.

|

| Post your journal to activate the Temporary credit limit |

Once completed, select Post to post your journal.

3 comments:

We just discussed how to handle this on our implementation status call YESTERDAY. Fantastic. Thank you!>

Hi Gadgetgeek,

I am glad you found this helpful! Stay tuned for more.

Thanks, this was helpful!

Post a Comment