A nice addition to the Subscription billing module is Expense deferrals. It's a subtle addition, and some may not even notice it's there! However, you may see benefit if you are part of an organization that pays for large subscriptions, memberships, or investments upfront and you require a methodology to defer these large expenses into an account then move these expenses from that deferred account into an expense account over a period of time.

This new addition is not quite as obvious as the Revenue deferral piece discussed in the previous blog: Subscription Billing - Revenue Deferrals, but it is very powerful and can be leveraged in any organization!

Let's look at how to set up Expense deferrals in Microsoft Dynamics 365 for Finance!

Deferral Defaults

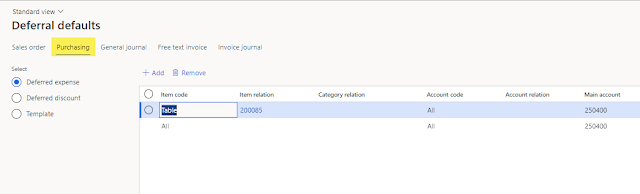

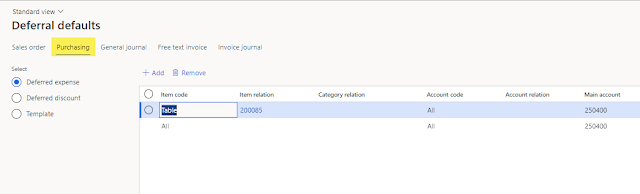

Similar to the Revenue deferrals, the Expense deferrals require some setup. First, you will want to determine where you want the expenses to defer to. Next, you will want to navigate to Subscription billing > Revenue and expense deferrals > Setup > Deferral defaults.

Within this screen, similar to Revenue deferrals, you will assign the deferral account to the items, item groups, vendors, vendor groups, or all of the above for purchases that need to be deferred. You can also assign discount deferral accounts as well on this screen.

|

| Deferral defaults for Purchasing |

Likewise, you can assign a template here for the methodology of how you want to defer those purchased items as well. In our example, item 200085 gets deferred using a straight-line template over 12 months.

If you want to read more about

Deferral templates, both straight-line and event-based, please refer to the

Revenue Deferrals blog for additional information. Both Revenue and Expense deferrals use the same set of Deferral templates.

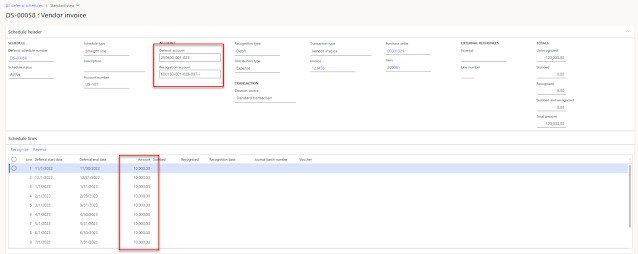

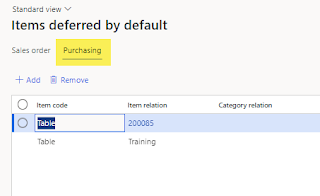

Items Deferred by Default

Item deferral for expenses cannot be setup manually from the Purchase order. In fact, there needs to be a setup done to indicate that the item must be deferred upon Purchase order invoice. This setup can be found at Subscription billing > Revenue and expense deferrals > Setup > Items deferred by default. Once an item is set up here and is assigned to a Purchase order that gets invoiced, then the item will automatically defer using the setups above.

Items can be deferred by Table, Group, or Category on this screen.

Expense Deferral Process

The process behind Expense deferrals happens in the background, so most people outside of the accounting department would be completely unaware that it is even happening.

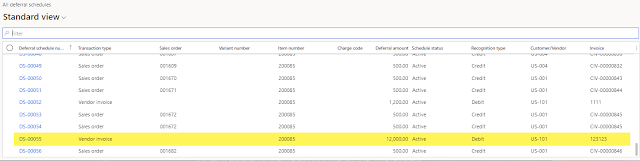

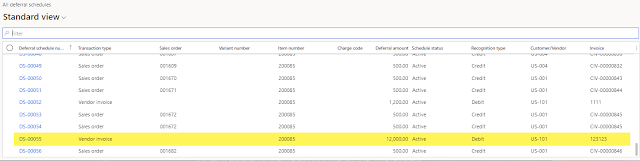

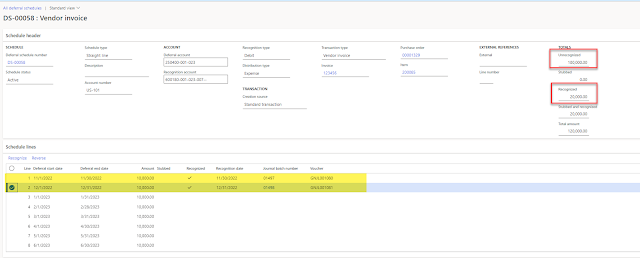

When a Purchase order is created in Dynamics, and the item that is setup for Expense deferral is applied to a Purchase order line, there is nothing in the Purchase order that indicates that the cost for that item is being deferred. Once the Purchase order is invoiced, the Deferral schedule will be available for recognition of expense in the Deferral schedules screen. The Deferral schedules can be found at Subscription billing > Revenue and expense deferrals > Deferral schedules > All deferral schedules.

Please note: The Revenue deferrals as well as the Expense deferrals are all located in this screen. Filters can be used to see only the records that you are wanting to see.

|

| View of Expense deferrals with Revenue deferrals |

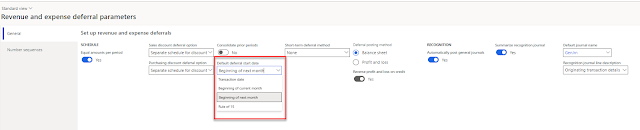

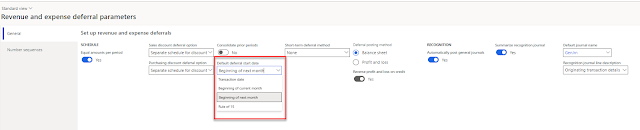

Select the transaction you are wanting to review. The Schedule lines will take the Purchased amount and spread the expense over the period of time specified in the Deferral template assigned to the item. The spread of the Recognition schedule can occur at the date of invoice, the first date of the current month, the first date of the next month, or the "Rule of 15." This will affect how the Expense deferral gets spread!

|

| Revenue and expense deferral parameters can help define the Deferral start date |

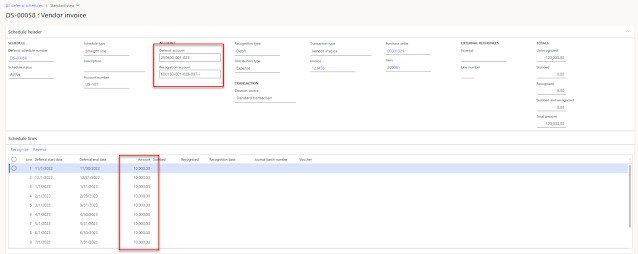

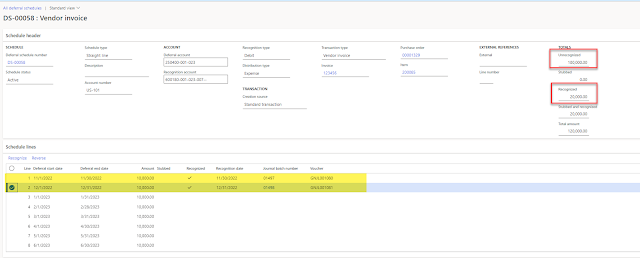

When reviewing the Deferral schedule for expenses, you can see the Purchase order number, the Invoice number, the Vendor account number, and the amount. Likewise, you can view the Deferral account and Recognition account - along with the defaulted Financial dimensions.

|

| Sample Expense deferral schedule lines |

When the Expense schedule lines get recognized, a General journal is created to move the amounts from the deferral account to the expense account, recognizing the expense in the period specified.

Similar to the Revenue recognition in the Revenue schedule lines, you can track the progress, review dates recognized, and see the General journal and voucher numbers on the lines.

|

| Recognized expenses show a Journal and Voucher number for easy traceability in the GL |

Since most companies will be working with more than one vendor or expense deferral during a period, there is also a place to view all open transactions that require recognition processing and these transactions can be executed in a batch job as well. You can find those at Subscription billing > Revenue and expense deferrals > Periodic tasks > Recognition processing or Subscription billing > Revenue and expense deferrals > Periodic tasks > Recognition batch processing.

2 comments:

I have a position that is only billed once (activation fee). When settling the accrual, it should be immediately resolved in the first month.

How can I set this up?

I have a position that is only billed once (activation fee). When settling the accrual, it should be immediately resolved in the first month.

How can I do that?

Post a Comment